Crypto of the Week (Argentina): QR payments and clear signals

- Larisa - LoQueArde

- Oct 26, 2025

- 3 min read

Who will be the first bar in your city to say:

“Paying in SOL or BTC?” 😎

When you can buy a big-ass croissant (“medialunón” 🇦🇷) with your favorite crypto… that’s when the future starts.

Imagine paying for a café con leche with MATIC or DOGE…

The waiter confused, you happy.

And your corner shop guy — will he jump in before your bank does?

If one day you pay for cheesy puffs with tokens…

don’t say I didn’t warn you 😏

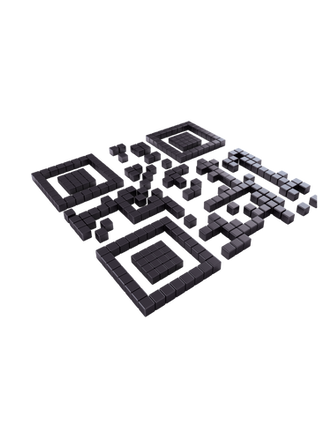

Binance launched QR payments in Argentina

The practical part: you pay with crypto and the app instantly converts it to ARS, with 100+ supported assets and no conversion fees (according to official statements).

If the merchant accepts a compatible QR, you just scan and done.

This brings crypto closer to everyday life ― no manual trading required.

(Sources: CriptoNoticias; Infobae)

USDT reaches 500 million users worldwide

According to Tether’s CEO Paolo Ardoino, USDT has reportedly reached 500M users worldwide.

Why does it matter? Because USDT is the most widely used bridge to enter and exit crypto in unstable economies: if the bridge grows, real usage grows.

(Sources: Paolo Ardoino — Tether CEO; CryptoBriefing)

Greater reach for the most-used “crypto dollar” = more on-ramps and off-ramps in unstable economies.. |

Bitcoin above USD 111,200 (Fri Oct 24)

Why did it rise?

The boost came from a positive macro environment after confirmation of a Trump–Xi meeting, which slightly eased perceived risk and pushed risk assets higher.

(Sources: The Economic Times; TheStreet)

Simple translation: when the big players see less conflict, they dare a bit more and BTC can breathe. |

Satoshi-era wallet moves 150 BTC after 14 years

Does it affect you? Not directly.

But these “OG whale” moves are cycle signals: old bitcoins change hands, and the market watches whether they’re selling or just reorganizing.

(Source: Cryptopolitan)

VanEck suggests that Bitcoin is in a mid-cycle correction, not a bear market

Real talk: it’s not a structural crash, it’s a pause to normalize (lower leverage, active on-chain).

It calms the “is everything over?” anxiety and lets you think in “seasons” instead of drama.

(Sources: VanEck; Bitget Research)

https://www.vaneck.com/us/en/blogs/digital-assets/matthew-sigel-vaneck-mid-october-2025-bitcoin-chaincheck/ https://www.bitget.com/news/detail/12560605026876

Mid-cycle reset driven by healthier liquidity/leverage, not the start of a bear market |

The top-100 cryptocurrencies are posting weekly positive returns, driven by the meeting between Trump and Xi Jinping.

The “warming up” tone from the Trump–Xi meeting lifted indexes and crypto. Emphasis: these are macro narratives; context, not a buy signal.

(Sources: TheStreet; CoinDesk)

How I read it (beginner mode, no hype)

Bridges (USDT): more adoption = more on/off-ramps.

Price (BTC 111K): reaction to macro climate, not “magic.”

Cycle signals (OG whales + VanEck): the movie isn’t over; we’re mid-season.

Real usage (QR in AR): if you can pay with what you hold, the day-to-day game changes.

Quick micro-glossary

Stablecoin (USDT): a “digital dollar” designed to stay ~1 USD.

OG whale: an account holding BTC from 2009–2011 that barely moved.

Mid-cycle: a pause/adjustment within a larger trend, not the end of the world.

Binance QR: you pay with crypto, and it’s converted to pesos on the spot.

Comments